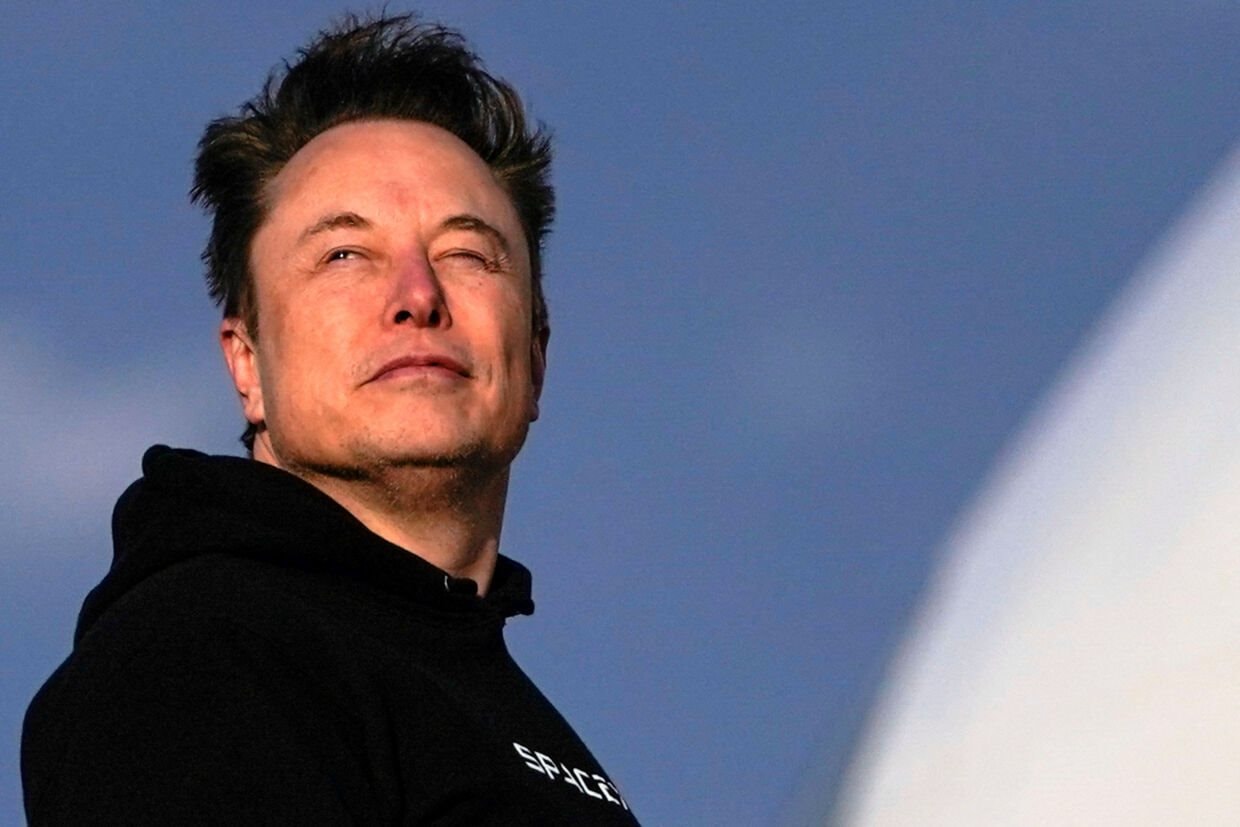

Will a miracle happen to Elon Musk and Tesla?

Tesla is facing a “perfect storm”: Stocks are falling, profits are plummeting, and showroom burning protests are taking place in many places. In this context, experts ask themselves the question of what could be the limit for Elon Musk to “wake up”? How much does Tesla stock need to fall before you can really return to running the company?

Investors partly got the answer today, when Tesla released its first-quarter financial report. At the beginning of the meeting with analysts, Musk said that from next month he will return to work at Tesla more, and only spend a few days a week on the “Ministry of Government Efficiency”, if the President still needs him. Tesla shares rose slightly in trading a few hours later.

It is undeniable that Musk’s time-consuming role at Doge has put pressure on Tesla stock. Since its post-election peak, no U.S.-listed company has lost more market capitalization than Tesla — with the exception of Apple and Nvidia, which are much larger.

At the current valuation of $750 billion, Tesla’s value is not supported by car sales, but by the belief that Musk can create a “miracle” — and it is important that he has time to do so.

Trade taxes and customer apprehension over Elon Musk’s political tendencies make the situation even more tense. Tesla’s electric vehicle revenue fell 20% in the last quarter, partly due to disruptions in factory restructuring, but also by a decline in demand.

Even the most loyal investors are starting to worry: Wedbush Securities recently lowered its price target for Tesla stock by more than 40%, suggesting that DOGE may have “burned” 20% of its future demand.

The question is: Does Musk really care about stock price fluctuations? Of course, he should be interested, because his stake in Tesla is now worth nearly $100 billion. But on the other hand, about 40 percent of his stake in rocket maker SpaceX is worth about $150 billion, based on the latest internal stock deal.

However, Musk has not promised to return to Tesla wholeheartedly; because, according to him, DOGE is on a mission to “save America from bankruptcy”.

For someone with a pioneering mindset, it’s understandable that Musk cares more about the future than the present. And that vision hasn’t changed so far: A future where Tesla produces millions of humanoid robots called Optimus, and family cars can earn extra by running like self-driving taxis in their spare time.

He again emphasized during today’s shareholder meeting that Tesla could be worth more than all five of America’s top companies combined, which is currently around $11 trillion.

Can shareholders hope to receive comprehensive attention from their “leaders” in the near future? Probably not. In the case of Trump’s tariffs, it is the bond market — not the stock market — that is causing the administration to rethink, given the risk of disrupting government funding.

Musk doesn’t need to worry too much about such issues. Tesla currently has $7 billion in debt, but holds more than five times that amount of cash.

At some point, Musk may need to raise more capital – he once made the assumption that training Optimus could cost up to half a trillion dollars. If that becomes a reality, the Tesla CEO will have more reason to care about how the market evaluates its time allocation. But for now, he can completely glance at the signals from the stock market without looking back.

News

Why US Pilots Called the Australian SAS The Saviors from Nowhere?

Phantoms in the Green Hell Prologue: The Fall The Vietnam War was a collision of worlds—high technology, roaring jets, and…

When the NVA Had Navy SEALs Cornered — But the Australia SAS Came from the Trees

Ghosts of Phuoc Tuy Prologue: The Jungle’s Silence Phuoc Tuy Province, 1968. The jungle didn’t echo—it swallowed every sound, turning…

What Happened When the Aussie SAS Sawed Their Rifles in Half — And Sh0cked the Navy SEALs

Sawed-Off: Lessons from the Jungle Prologue: The Hacksaw Moment I’d been in country for five months when I saw it…

When Green Berets Tried to Fight Like Australia SAS — And Got Left Behind

Ghost Lessons Prologue: Admiration It started with admiration. After several joint missions in the central Highlands of Vietnam, a team…

What Happens When A Seasoned US Colonel Witnesses Australian SAS Forces Operating In Vietnam?

The Equation of Shadows Prologue: Doctrine and Dust Colonel Howard Lancaster arrived in Vietnam with a clipboard, a chest full…

When MACV-SOG Borrowed An Australian SAS Scout In Vietnam – And Never Wanted To Return Him

Shadow in the Rain: The Legend of Corporal Briggs Prologue: A Disturbance in the Symphony The arrival of Corporal Calum…

End of content

No more pages to load